![]() We venture to say that our refunds policy is not only progressive and fair-minded, but that it's also quite generous

We venture to say that our refunds policy is not only progressive and fair-minded, but that it's also quite generous  and at the forefront of the picture framing industry. We propose this commendation because the Australian Consumer Law legislation, in specific cases, restricts the payment of refunds ( inter alia ) by excluding this entitlement to certain Customers where and when " .. Customers just changed their mind about buying a product, or found the same product cheaper elsewhere , or simply decided they didn't like the products or could not use it". Felicitously for all Customers, our Terms and Conditions of Sale page advises that they can return most goods ( Conditions and Limitations apply ) bought from us for any reason within 30 days of delivery. Succinctly then, the Buyer's Remorse, or CHOM, ( Change of Mind ) quandary is easily resolved by allowing Customers to return most ( Conditions and Limitations apply ) purchases within 30 days, no questions asked.

and at the forefront of the picture framing industry. We propose this commendation because the Australian Consumer Law legislation, in specific cases, restricts the payment of refunds ( inter alia ) by excluding this entitlement to certain Customers where and when " .. Customers just changed their mind about buying a product, or found the same product cheaper elsewhere , or simply decided they didn't like the products or could not use it". Felicitously for all Customers, our Terms and Conditions of Sale page advises that they can return most goods ( Conditions and Limitations apply ) bought from us for any reason within 30 days of delivery. Succinctly then, the Buyer's Remorse, or CHOM, ( Change of Mind ) quandary is easily resolved by allowing Customers to return most ( Conditions and Limitations apply ) purchases within 30 days, no questions asked.

For example, here is a typical refund transaction that's occurred more than once. A Customer orders and pays for the shipping of a couple of 12"x18" black poster frames. After receiving the frames, the Customer discovers that that these are the wrong size and that some odd, larger frame size, which we do not stock, is needed. Realizing that she made an ordering error, the Customer changes her mind about wanting to keep the frames and emails us asking for a refund. We agree to her CHOM request, once the incorrectly ordered frames are returned to us. The Customer then posts the frames back to us. We later receive them, check them, verify that these are still in good order, fit for resale, and later refund the Customer, less the shipping costs of course, as these were incurred, in good faith, for and by the Customer.

Once the Customer and ourselves have agreed on the refund amount, we need to decide on how the refund will be made. Australian Consumer Law states that refunds ought to made by the same method as the payments were received, which is usually this is by way of Credit Card. However we simply are unable to refund this way because our best-practice security protocols do not permit us to, even temporarily hold, retain, keep, copy or store, Customers' Credit Card details, for very good and obvious security reasons.

On our refund notifications we advise of this to Customers and ask them for for BSB details to which we may EFT the refund. Once these details are emailed to us, we normally refund on the very same day. This is a simple, good, fast, safe, transparent and cheap payment method which has never failed us in 20-odd years of online trading.

Occasionally a Customer has asked to be refunded by other methods, such as Osko, PayID, or BPAY , however, and for the Customer's own financial safety and security we either are unable to, or we decline, to use those payment procedures. So far as we are concerned, EFT is the good guy, the other guys are either bad or ugly, hence the title of this post: " Refunds, The Good, The Bad and The Ugly. "

Think that we're being too picky? Well then, lets' review some cringeworthy examples about the internt's touted, superlative, super-secure, foolproof, payments networks gateways:

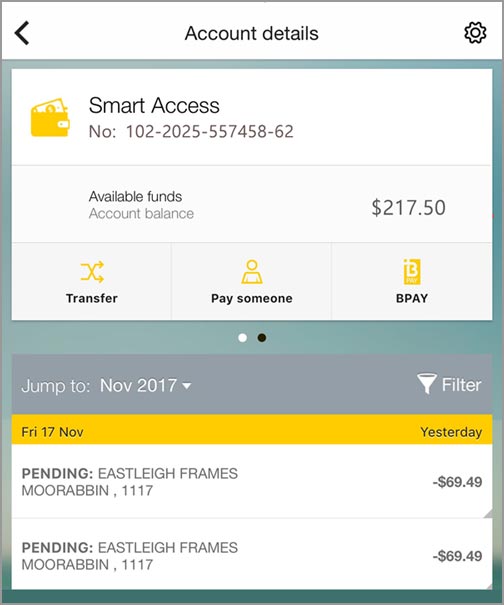

Example 1) Smart Access Phone Payment: A Customer places an online order for a Football Display Case costing $69.49. We process the payment, generate the Invoice and soon after begin to pick and pack the order. A little later we get an imperious email request: " Hi, I’ve just checked my bank account and have been charged twice for my order. Can you please refund the additional charge immediately ? " segued with the below screenshot:

Had we relied on the Customer's statement and supporting evidence we would have refunded the alleged, second, additional payment the Customer was complaining about. Had we done so we would have fallen victim for someone's clever scam or careless error, and would have lost money on the transaction. But, we knew better.

This is because we process all our orders the old-fashioned way, manually, not automatically. We have never used and will never use payment gateways, third-party provider, facilitators or aggregators since we do so ourselves, personally. On reading the Customer's email we knew instantly that there was no double-debiting or a payment processing error on our part because we solely and strictly debit Customer's Cards once and once only.

When, who, where, how or why the incorrect information was created and downloaded to the Customer's smart phone we do not know, nor did the Customer provide a satisfactory explanation to us because we never heard from her again.

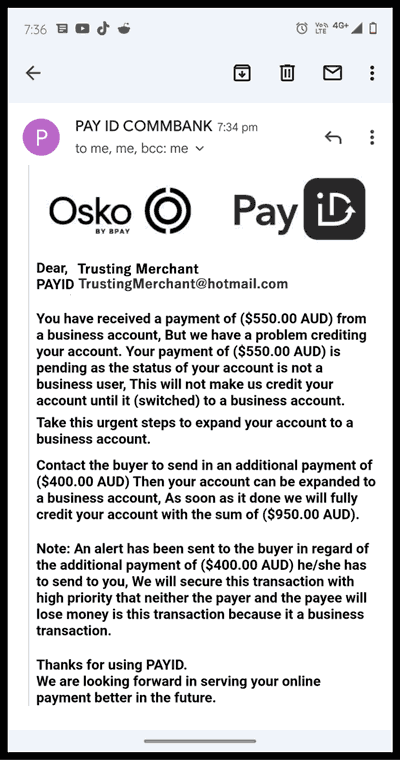

Example 2) PayID Phone Payment: This is in much the same vein as the previous, untrustworthy, transaction. A new Customer ordered a small Art Deco mirror but did not want to pay by Credit Card or Bank Deposit. He was also in a hurry for the goods to be shipped as the mirror was a birthday present.

A little while later we received a message very much like the one below. It asked us to arrange for more money to 'facilitate' the initial money transfer. Needless to say we immediately stopped all contact with the new Customer ( who never paid anyway ) and simply cancelled the order. Again, there followed a deafening silence from the Customer.

3) BPAY Email Payment Advice. This one was a little different form the two previous spoofs in so far that we it received it by email, not via smart phone. Nevertheless the intent and purpose was much the same, to falsely induce and convince a Merchant to accept, process and ship dispatch goods by using a manufactured proof of a dubious payment document.

More deviously, the attachment, which was automatically scanned before opening it, contained a malware file. Again, the format of the email and the counterfeiting of the known financial institutions logos is quite sophisticated, all designed to lull and lure the recipient in a false sense of security and so open the attachment, with all the problems that would create and entail.

The moral of this post should be abundantly clear. We will only pay refunds by our true and tested method via EFT to a nominated BSB Account.

A security expert might argue that EFT payments to BSB accounts aren't foolproof either and that scams are also perpetrated in this area. While this may be true, we minimize, if not obviate, most, if not all, risks by communicating via safe, rather than electronically secure channels, since nothing and no computer programme, application or platform is truly secure anyway.

Above all, we do not use smart phones, generate, provide, furnish, visit, or request hyperlink, PIN, token, code or passcode interactions of any kind either to or from our Customers. Thank you for reading this post "Refunds, The Good, The Bad and The Ugly".